Review of Fiscal 2024 and Performance Forecast for Fiscal 2025

It should also be noted that excluding the Pharma Business of Mitsubishi Tanabe Pharma Corporation,* of which all shares were transferred as of July 1, 2025, our fiscal 2024 results are sales revenue of ¥3,947.6 billion, core operating income of ¥228.8 billion, and net income attributable to owners of the parent of ¥45.0 billion.

For fiscal 2025, we project sales revenue of ¥3,740.0 billion and core operating income of ¥265.0 billion. While sales revenue is expected to decrease by around 5% from our fiscal 2024 results excluding the Pharma Business, core operating income is projected to increase by approximately 16%. Although net income attributable to owners of the parent is expected to total ¥145.0 billion in fiscal 2025, this figure includes approximately ¥94.0 billion in gains on the transfer of the Pharma Business and profits made prior to the transfer. Excluding this amount, net income attributable to owners of the parent, in actual terms, is expected to be at the same level as fiscal 2024.

* The company will be renamed as Tanabe Pharma Corporation on December 1, 2025.

Medium-Term Management Plan 2029

* Excluding the Pharma Business

Profit Growth Outlook

1. With regard to Industrial Gases Business, Mitsubishi Chemical Group Corporation has made its own estimates based on “NS Vision 2026”, which was formulated by Nippon Sanso Holdings Corporation in 2022, and incorporates the effects of continuous demand growth, price management, productivity improvements, etc.

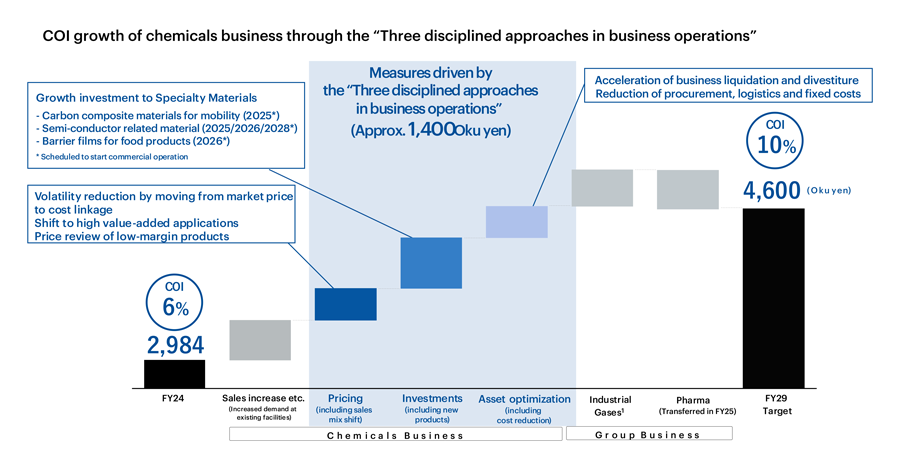

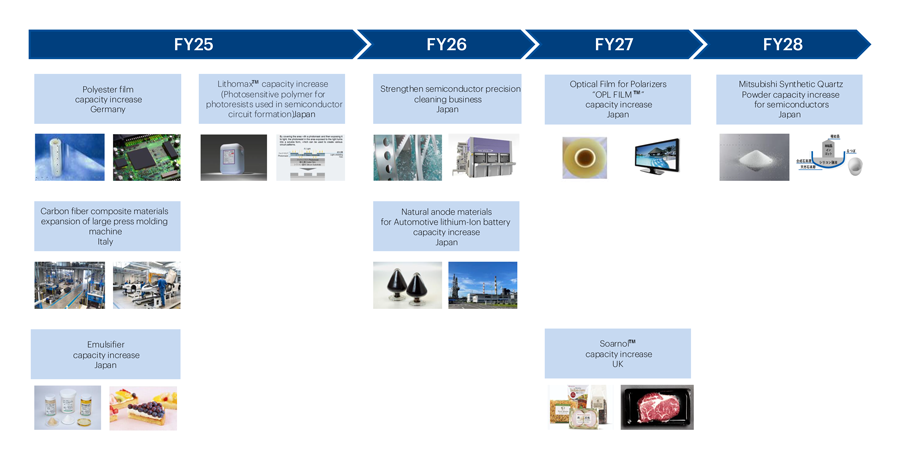

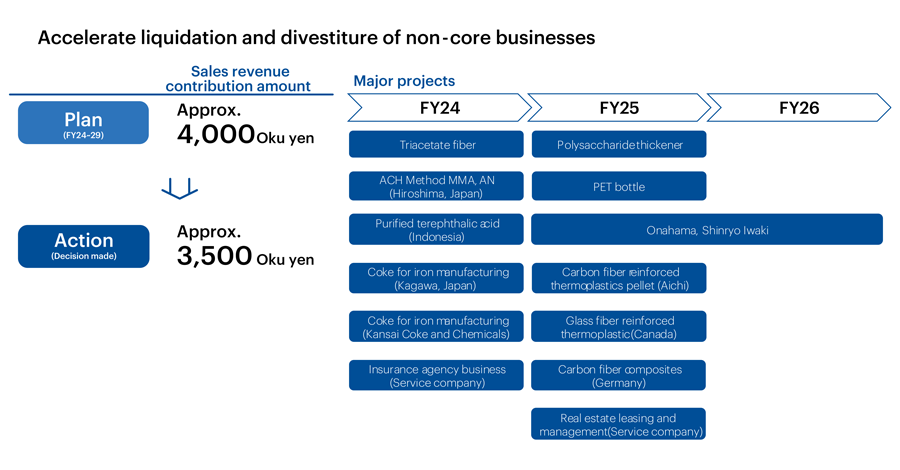

Transformation of Our Chemicals Business Portfolio

Under New Medium-Term Management Plan 2029, we expect to incur restructuring costs equivalent to around ¥400.0 billion in sales revenue in the Chemicals Business, of which approximately ¥350.0 billion has already been determined as of August 1, 2025. We have undertaken several business restructuring measures, including reducing capacity by 40% at our steelmaking coke plant in Kagawa Prefecture, transferring all shares of Kansai Coke and Chemicals Company, Limited, closing down our plants in Hiroshima Prefecture for MMA monomer and acrylonitrile-related products, and withdrawing from the PET bottle business. Production at the Onahama Plant in Fukushima Prefecture will also be phased out by the end of March 2027.

As we transform our business portfolio, we are currently in a transitional period toward our vision of where we want the Group to be 10 years from now. While there will be some difficulties and hardships during this period due to structural reforms, we expect a significant growth in profits as a result and will be able to fully meet the expectations of shareholders and investors. By clearly and thoroughly disclosing our management policies and performance, particularly profit growth during this transitional period, we will strive to strengthen our relationship of trust with shareholders and investors.

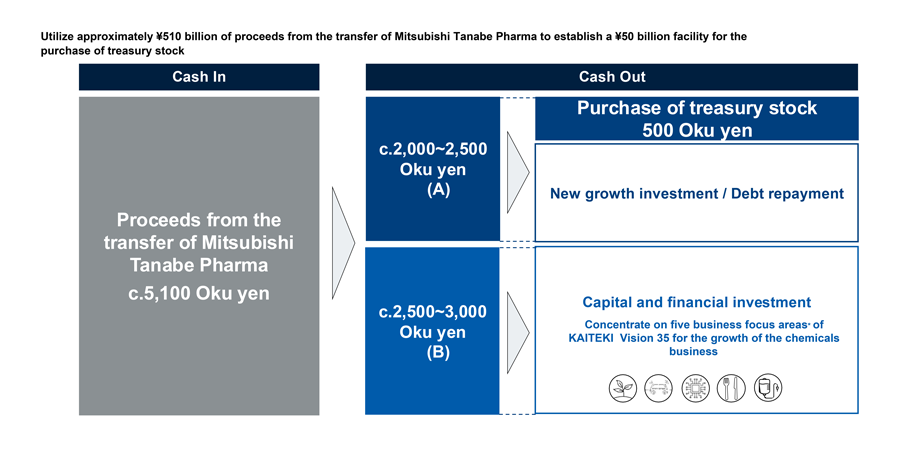

Background and Effects of the Pharma Business Transfer

While this transfer generated approximately ¥510.0 billion in funds, we believe the actual additional cash inflow is approximately ¥180.0 billion, as the remaining ¥330.0 billion is seen as an advance on the cash flow that the Pharma Business was expected to generate over the next five years.

Of the approximately ¥510.0 billion in consideration for the transfer, ¥200.0 billion to ¥250.0 billion (“A” in the chart) will be allocated to new growth investments, debt repayments to improve our financial position and secure borrowing capacity for future strategic investments, and shareholder returns through treasury share acquisitions.* The remaining ¥250.0 billion to ¥300.0 billion (“B” in the chart) will be used for concentrated capital and financial investments in the five business focus areas of KV35 necessary for the growth of the Chemicals Business, as set forth in Medium-Term Management Plan 2029.

* The treasury share acquisition of up to ¥50.0 billion announced on May 13, 2025 was finalized on August 1, 2025.

* Stable supply platform for green chemicals, Eco-conscious mobility, Enable advanced data processing and telecommunications, Food quality preservation and Technology and equipment for new therapeutics.

Optimization of the Capital Structure Through Balance Sheet Management

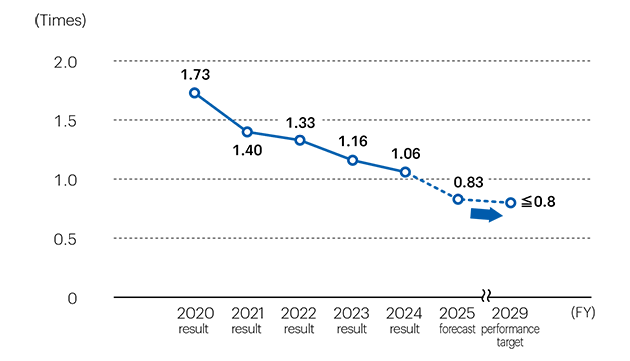

At present, we believe a net debt-to-equity ratio of 0.8 times to be a sound and appropriate level for the Group. In fiscal 2025, we expect our net debt-to-equity ratio to approach this level, improving to 0.83 times through the acquisition of treasury shares and debt repayments. Sustaining this level through to fiscal 2029—the final year of Medium-Term Management Plan 2029—is one of our financial goals. We will utilize borrowings as appropriate while keeping our cost of capital in mind and maintain an optimal asset size commensurate with revenue and profits. We believe that striking a balance between debt and equity will lay the foundation for sustainable management.

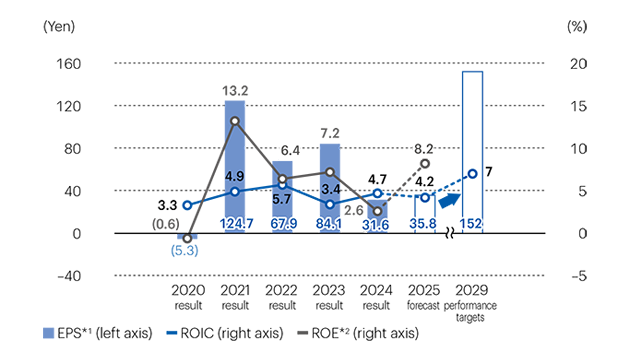

Improvement of ROIC Through Increased Profitability and Asset Reduction

*1 EPS calculation excludes the profit of discontinued operations. Following the resolution of the transfer of Mitsubishi Tanabe Pharma Corporation at the Group’s annual shareholders’ meeting, the Pharma Business has been classified as a discontinued operation. Accordingly, the forecast for fiscal 2025 and target for fiscal 2029 exclude this business from the scope of earnings per share (EPS) for continuing operations. EPS for the fiscal year ended March 2025 calculated with this exclusion is (1.7) yen.

*2 FY29 performance targets for ROE are not disclosed.

The Group is also focused on reducing fixed costs. To steadily reap the benefits of the 2017 integration of the former Mitsubishi Chemical Corporation, Mitsubishi Plastics, Inc., and Mitsubishi Rayon Co., Ltd., we will strive to reduce fixed costs, particularly by streamlining indirect functions, and consistently raise our profit levels.

Furthermore, to improve ROIC, we must address underperforming businesses. The Carbon Products subsegment, in particular, continues to incur significant losses, reporting a core operating loss of ¥27.5 billion in fiscal 2024. In fiscal 2024, we took measures such as cutting production, and fiscal 2025 will be a critical period in which the effectiveness of these measures will be tested. We will do everything in our power, including optimizing our sales portfolio and implementing thorough cost reductions, to restore profitability as quickly as possible.

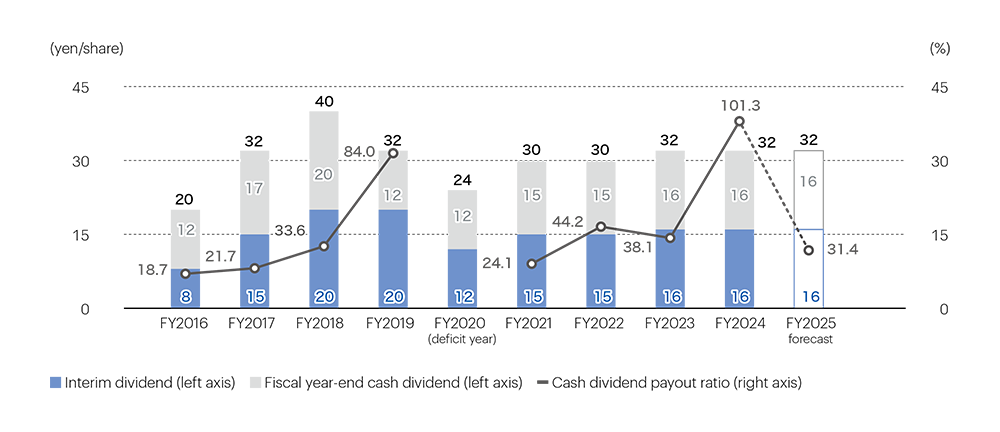

Shareholder Return Policy

In fiscal 2025, we expect net income attributable to owners of the parent to amount to ¥145.0 billion. While this should lead to a dividend payout ratio of 31.4%, we believe the figures are in line with our shareholder return policy, given that fiscal 2025 profits include a one-time gain on the transfer of the Pharma Business.

Role as Chief Financial Officer

I believe it is my responsibility to continue to communicate such messages for change, encourage frank discussions, and deepen insights throughout the organization. I intend to make persistent efforts to continuously drive the Group’s transformation and growth going forward.

Approximately a year and a half* has passed under the current management structure, and we are approaching the halfway point of our initial goal of demonstrating results within three years. The Specialty Materials segment, an area of particular focus, is starting to show signs of sustainable growth. We will implement measures in an even timelier manner so that shareholders and investors can also gain a sense of this growth. Through these efforts, we will strive to communicate the certainty of the Group’s transformation and growth more clearly. We hope that our shareholders and investors will continue to observe the Group’s activities with great anticipation.

* As of September 2025