KAITEKI Vision 35

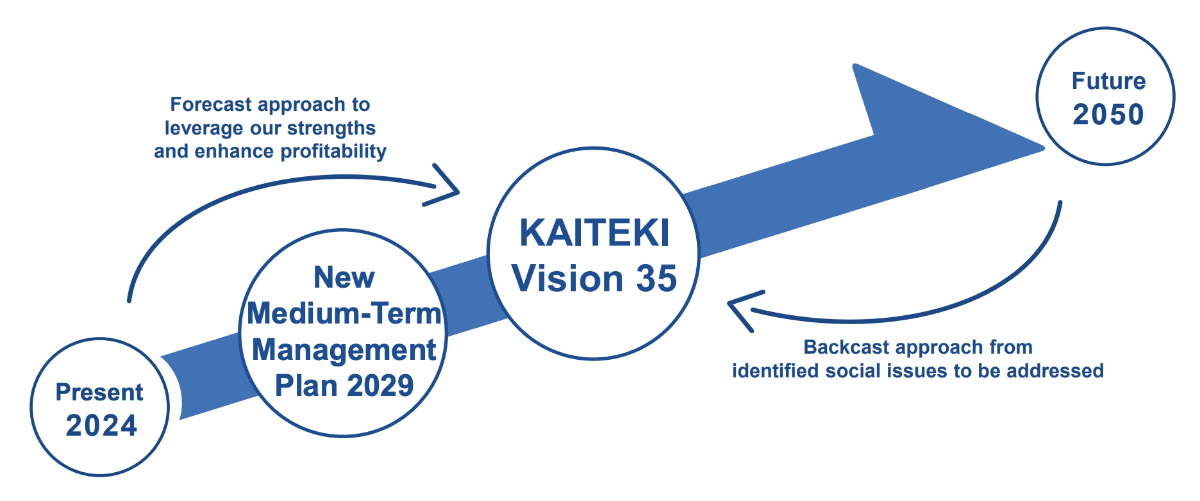

Mitsubishi Chemical Group Corporation has formulated a new management vision “KAITEKI Vision 35” that outlines its aspirations for 2035, and a “New Medium-Term Management Plan 2029,” covering the five years from FY2025 to FY2029.

KAITEKI Vision 35

Our Vision for 2035

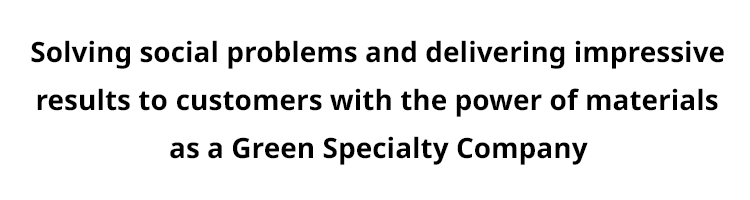

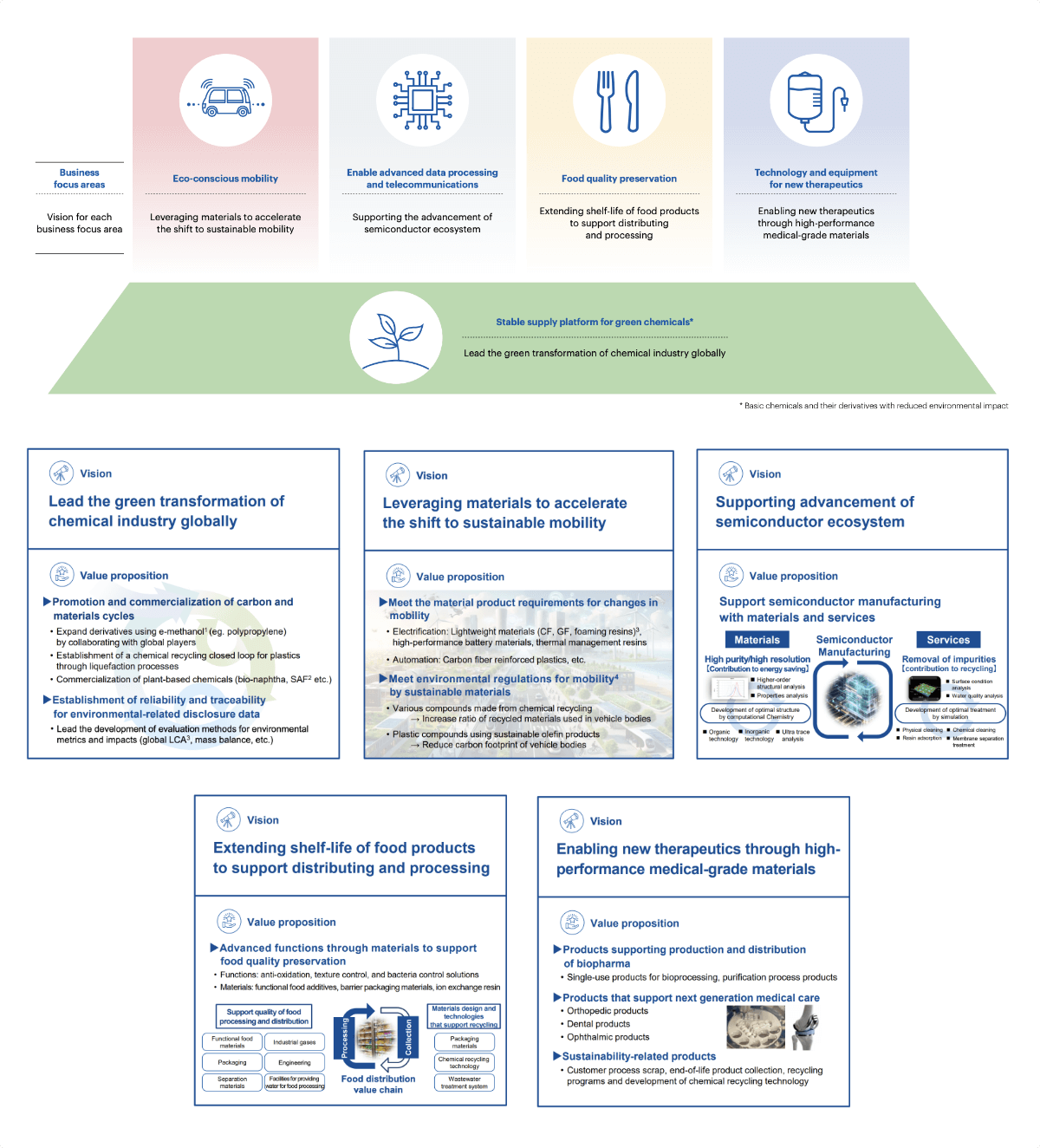

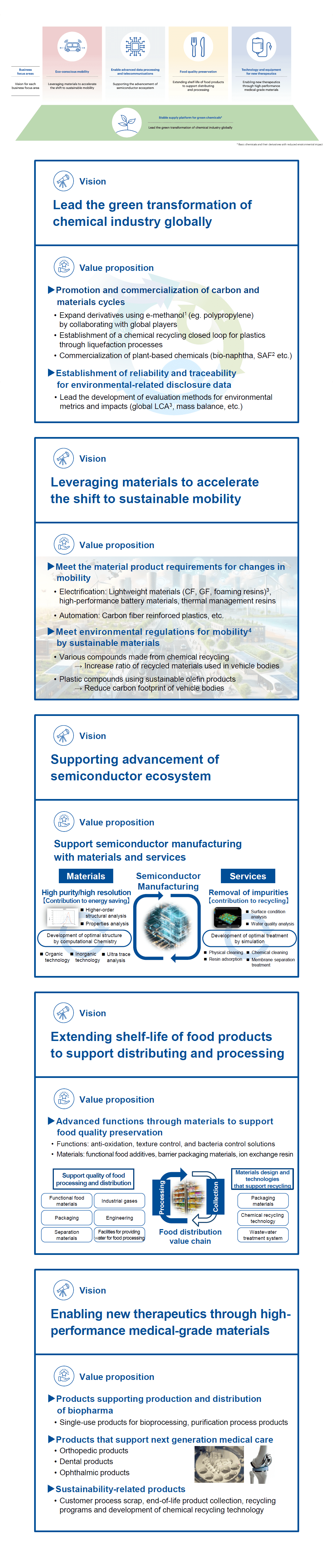

Our Vision across five business focus areas

By clarifying our Vision across five business focus areas where we can make the most of our strengths, we aim to become a Green Specialty Company that continues to provide optimal solutions for society.

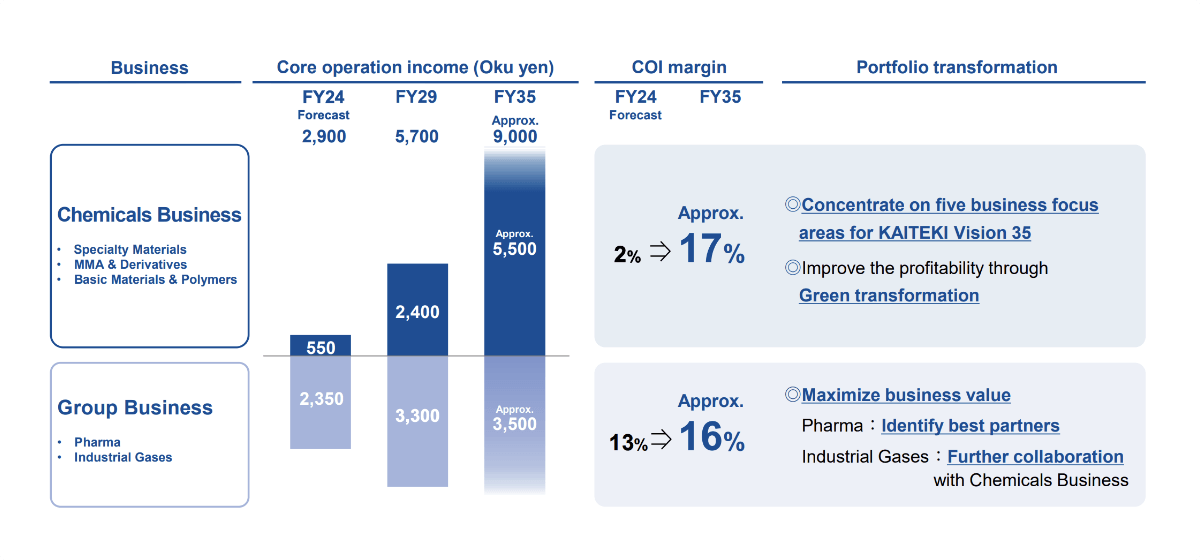

Business structure and profit level toward 2035

COI of the Chemicals Business will exceed the total COI of the Group Businesses in 2035

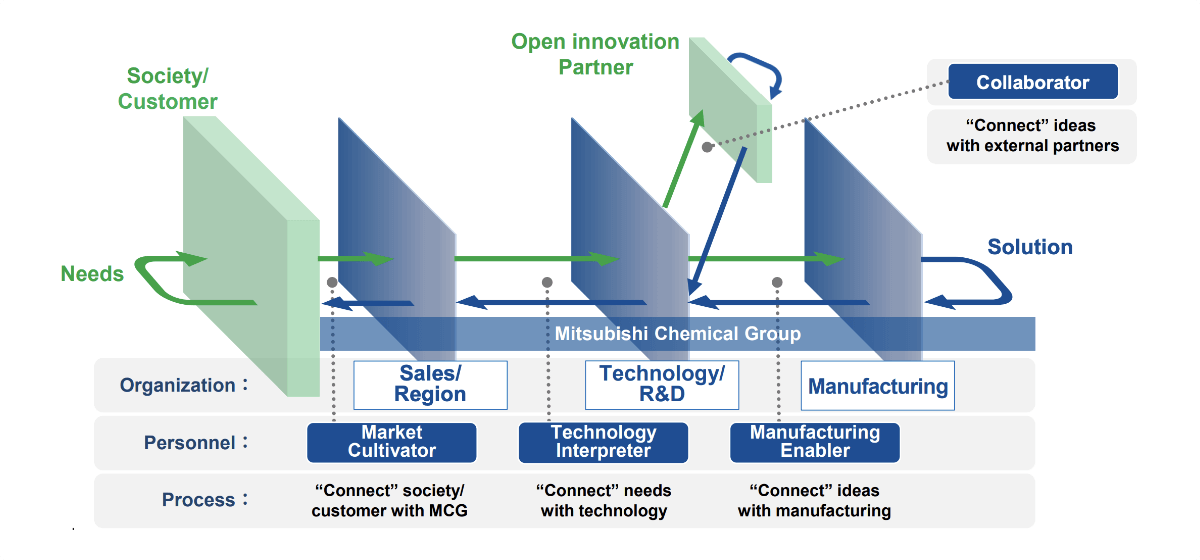

Organization, processes and resources to become the Green Specialty Company

“Connect” customer needs with innovative solutions to deliver the best societal outcomes with agility

November 13, 2024

Corporate strategy meeting「Vision & Strategy」