Review of fiscal 2023

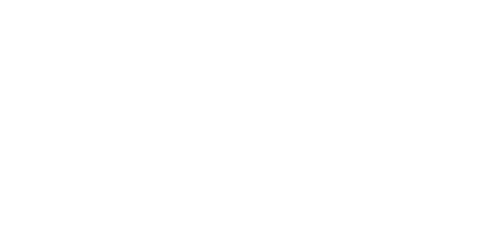

Meanwhile, it was also a year in which we began to see the results of steady improvements to our financial position. For example, although we had initially targeted ¥80.0 billion in cost reductions, withdrawal from the COVID-19 vaccine development business, structural reform of MMA sites in Europe, consolidation of indirect procurement bases since fiscal 2022, and other factors contributed to cost reductions of ¥100.6 billion. We also increased profits by ¥34.3 billion through efforts to ensure that customers recognized the added value of our products as well as price management strategies. Furthermore, through the sale of non-core businesses and the steady progress of our efforts to reduce working capital, we generated free cash flow of ¥219.1 billion.

Forecast of business performance in fiscal 2024

At the end of the first quarter, our core operating income stood at ¥82.6 billion, owing to strong sales of display-related products and semiconductor-related products for generative AI as well as the positive effect of higher MMA monomer market prices. Although we are on track to surpass our initial core operating income forecast of ¥110.0 billion for the first half of fiscal 2024, we have left this figure unchanged due to the uncertainty of demand trends, the need for further review of several business restructuring projects, and the difficulty in incorporating such impacts on earnings at this time. There is no question that this initial forecast is a goal we must achieve, and we are working collectively as a Group to do so.

Focus on balance sheet management

As I stated earlier, we have made steady progress in our efforts to optimize working capital, such as through inventory reductions. However, we will need to closely monitor our inventories to ensure that they do not increase even with an expansion in sales volume. When I worked at Mitsubishi Rayon Co., Ltd., one of the parent companies of Mitsubishi Chemical Corporation, I was keenly aware of the horrifying impact a rapid increase in inventory in the textile business could have on cash flows. I feel that, over the past few years, an awareness of working capital and inventory has firmly taken root among our frontline employees. That said, I will continue to promote awareness of the importance of not carrying more inventory than necessary.

Management of ROIC to enhance corporate value

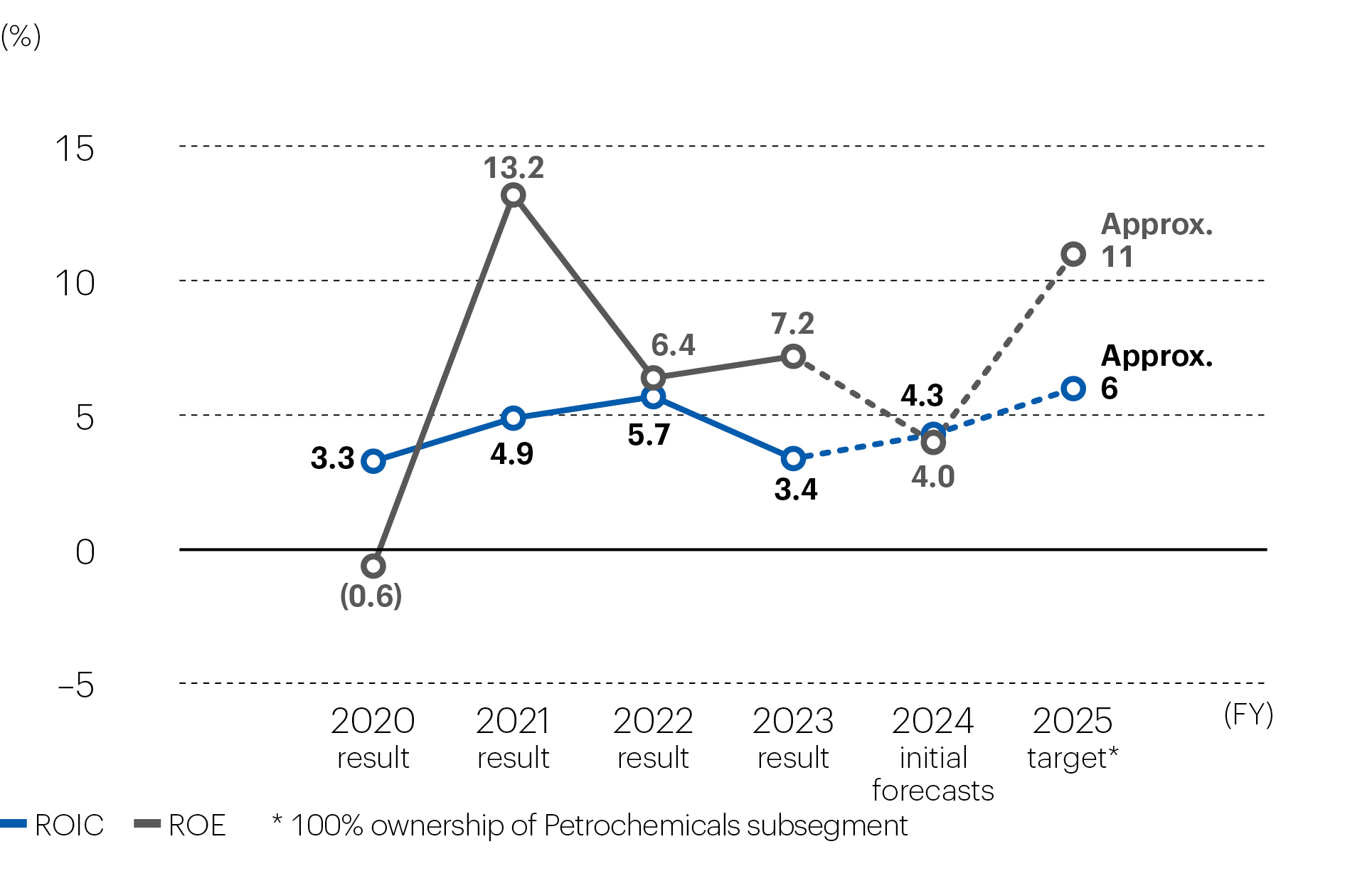

Due to its ease of application, we will use return on invested capital (ROIC) as an internal management indicator for conducting improvement activities, aiming to achieve ROIC of between 7% to 8% for the time being, which is equivalent to ROE of 10% and a level that exceeds our expected cost of capital. In fiscal 2024, we expect ROIC to be around 4.3%. Despite the positive impact of the Industrial Gases and Pharma segments, the capital efficiency of the Specialty Materials, MMA & Derivatives, and Basic Materials & Polymers segments is pushing down ROIC. Going forward, we will conduct a further review of our business portfolio to raise the capital efficiency of the Group as a whole. In the Specialty Materials segment in particular, we aim to increase ROIC to a level that is equal to or exceeds that of the Industrial Gases segment in the medium term.

To improve ROIC, we must determine how to reduce our invested capital (denominator) and increase profit (numerator). To increase the numerator, we began implementing a price management strategy, which we termed “elimination of negative margins,” in all of our businesses. By negotiating with clients through which we can improve our gross margin and ensuring that they recognize the added value of our products, we will continuously strive to expand our profit margin.

As for reducing the denominator, aside from lowering working capital, we will also consider reductions to fixed assets and review the cycle of periodic repairs and equipment replacement. In addition to systematically organizing and visualizing the activities we have undertaken for some time, I would like to see us take one step further by identifying how we can improve in areas we have yet to fully exploit.

ROIC is managed more precisely for each segment than for their respective subsegments, which disclose their ROIC separately, and is broken down into components to identify the elements and measures that play a significant role in its improvement. Currently, we are training ROIC ambassadors to serve as internal proponents and preparing manuals, and we plan to undertake Companywide activities aimed at improving ROIC from the latter half of fiscal 2024.

Capital allocation and business portfolio selection

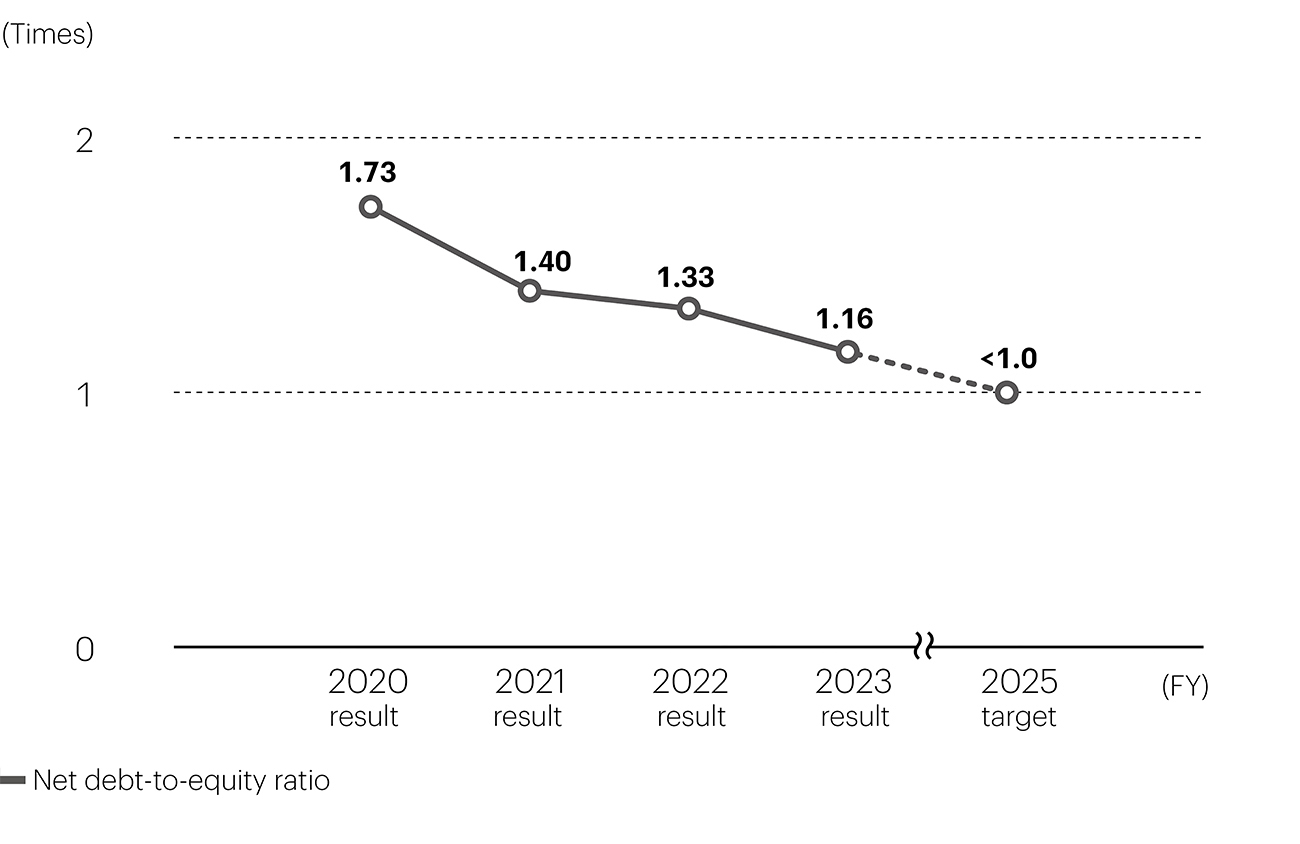

Our basic policy for shareholder returns is to maintain a dividend payout ratio of 35% for the time being. At the same time, as I mentioned earlier, we will allocate capital to strengthen our financial base in order to reduce our net debt-to-equity ratio to less than 1.0 times.

When deciding on growth investments, I understand the need to be conscious of capital efficiency and to be selective. In particular, we are examining which areas to focus on in the Specialty Materials segment, which handles a wide range of products, so that we can make a concrete announcement in November 2024. In determining our business portfolio, we use financial indicators, such as ROIC, as hurdle rates while considering other factors. We will also examine whether the business in question contributes to the resolution of social issues in light of our Purpose of realizing KAITEKI and whether it is a business that the Group will excel in and can expect to grow over the long term.

My role as CFO going forward

To date, the Group has been investing in each business toward their medium- to long-term growth. Going forward, we will continue to make growth investments and improve the efficiency thereof while developing a solid financial structure that is less susceptible to economic fluctuations. To do so, we must not only devise a clear strategy but also make small efforts on a daily basis, such as improving the ROIC of each worksite. Taking the seemingly obvious approach is not always easy, but I will support the entire Company in doing so.

I am also aware that, as CFO, I must act as a liaison between stakeholders and the Group, including through dialogues with investors at IR activities and accurate financial reporting. I will thus create various opportunities to actively engage in dialogue with stakeholders and deepen mutual understanding to enhance the Group’s corporate value.